Earn More with liviSave

Grow your money every day with our competitive savings interest rate*

* Terms and Conditions apply.

Grow your money every day with our competitive savings interest rate*

* Terms and Conditions apply.

.png)

.png)

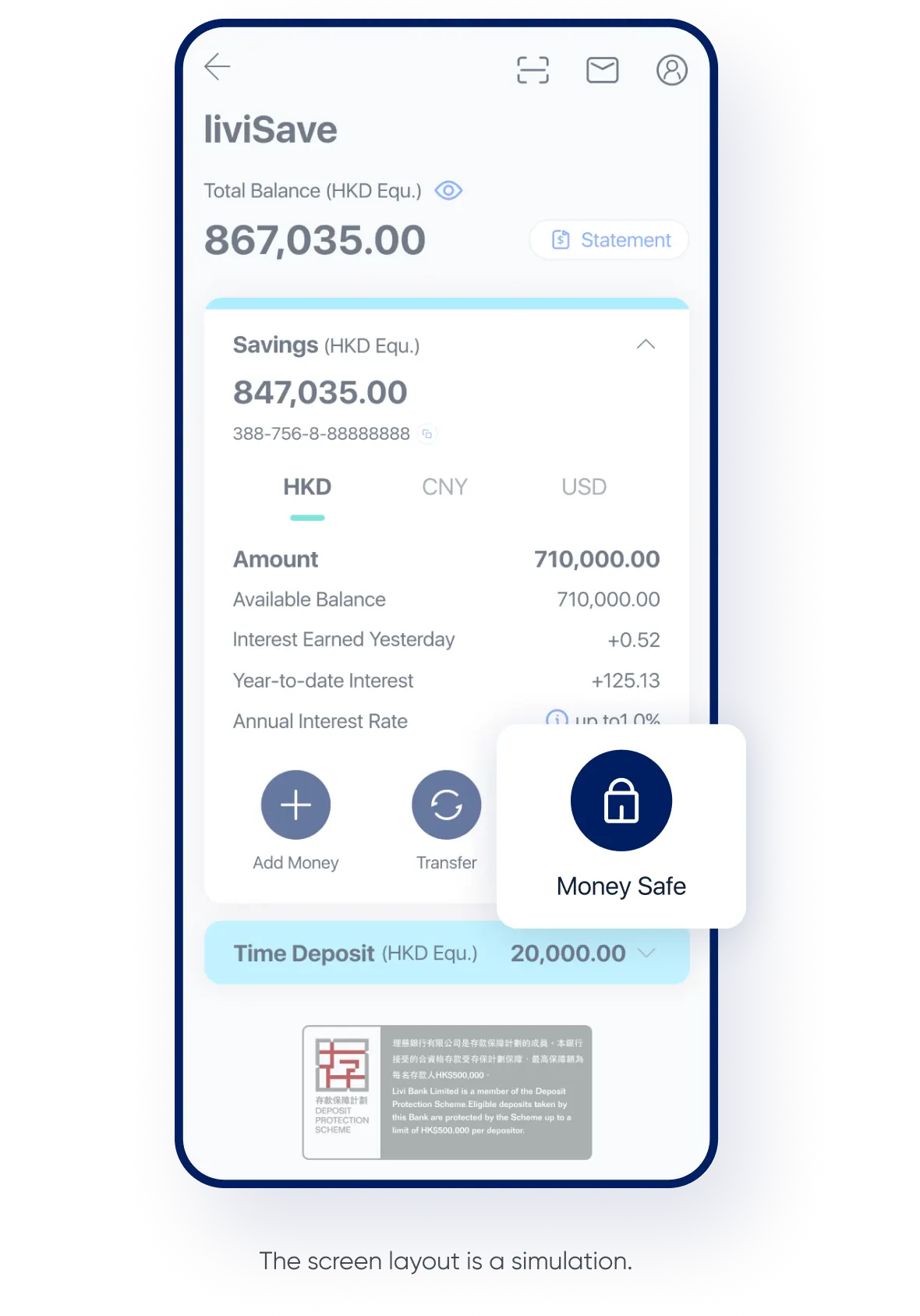

liviSave helps you put your money to work.

Open liviSave and earn interest on your savings account.

Save and transfer money at any time.

No fees. No matter how much or little you put in.

Lock your account balance at any time to prevent scams and fraud.

Account Balance: |

Annual Interest Rate |

|---|---|

First 50,000 HKD or below |

1.000% p.a. |

Above 50,000 HKD to 500,000 HKD |

0.400% p.a. |

Remaining |

0.125% p.a. |

Account Balance: |

Annual Interest Rate |

|---|---|

First 1,000,000 CNY or below |

1.00% p.a. |

Remaining |

0.25% p.a. |

Account Balance: |

Annual Interest Rate |

|---|---|

All deposits |

3.088% p.a. |

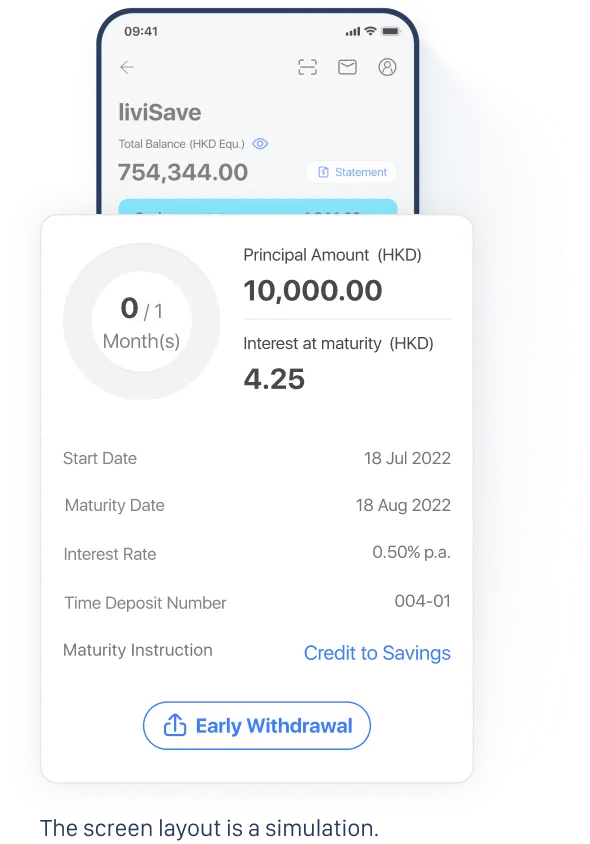

| Deposit Amount (HKD) | 500 - 49,999.99 | 50,000+ |

|---|---|---|

| 7 Days | 0.25% | 0.25% |

| 1 Month | 0.50% | 1.20% |

| 2 Months | 0.50% | 0.50% |

| 3 Months | 1.10% | 2.50% |

| 4 Months | 1.20% | 2.30% |

| 6 Months | 1.30% | 2.20% |

| 9 Months | 1.30% | 2.00% |

| 12 Months | 1.60% | 2.00% |

| Deposit Amount (HKD) | 500 - 49,999.99 | 50,000+ |

|---|---|---|

| 7 Days | 0.25% | 0.25% |

| 1 Month | 0.50% | 1.20% |

| 2 Months | 0.50% | 0.50% |

| 3 Months | 1.10% | 2.50% |

| 4 Months | 1.20% | 2.30% |

| 6 Months | 1.30% | 2.20% |

| 9 Months | 1.30% | 2.00% |

| 12 Months | 1.60% | 2.00% |

Last Update 23 February 2026 22:51

Tenor |

USD100 or above |

|---|---|

1 month |

1.50% |

3 months |

3.50% |

6 months |

3.40% |

12 months |

3.20% |

Tenor |

CNY500 or above |

|---|---|

1 month |

1.00% |

3 months |

1.10% |

6 months |

1.10% |

12 months |

1.30% |